Auto Loans

Don't Wait For Your Next Adventure

Low Auto Loan Rates for Both New & Used Vehicles

With a UTF auto loan, you don’t have to wait for approval. We offer quick pre-approvals so you can into that new vehicle fast at a great rate.

As a not-for-profit financial institution, we’re able to offer some of the best auto loan rates in the business. Plus, you’ll experience a wide range of other perks including:

-

New & Used Vehicles

-

Flexible Loan Terms For Up to 84 Months*

-

No Application Fees

Boats, Motorcycles & RVs, Too

We don’t limit our auto loans to cars and trucks. We also approve loans for boats, motorcycles and RVs, too. Whatever dream you have, we’re here to help make it happen.

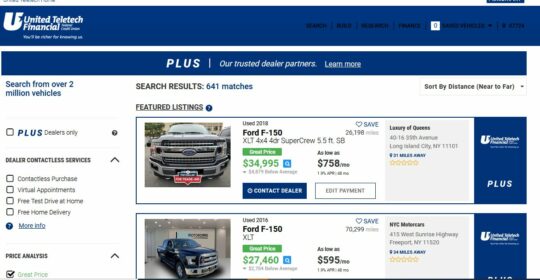

Search Local Dealerships With Our Car Finder Tool

With our car finder tool you can browse a large selection of cars and trucks online from a variety of nearby dealerships. We can help you find a car and get you pre-approved without leaving the comfort of your home.

FAQs & More Information

How Do You Apply for an Auto Loan?

Getting preapproved for an auto loan only takes a few minutes. Here we walk you through the process and answer the most common questions about applying for an auto loan. Learn more by visiting us today.

How to Get the Best Auto Loan Rate

You can take action to improve your interest rate for an auto loan. Learn how your credit score impacts your interest rate and how to shop around for lenders.

How Does Auto Loan Refinancing Work?

Is your auto loan holding you back from your financial goals? Refinancing may lessen your interest rate and monthly payments. Learn when to consider this option and whether it’s right for you.

How Can I Qualify for an Auto Loan?

You’ll need to prepare some paperwork for your auto loan and save up for a down payment. And if you’re worried about your credit score, we’ve got you covered. Learn what you can do to qualify.

Auto Loans and Your Credit

Your credit score and credit history can influence the interest rate, loan amount and other important features of the auto loan you receive.

Understanding Pre-Approvals, Approval and Co-Signing

Are there advantages to getting a loan pre-approved before going to the dealer? Should you have a cosigner? What else do you need to get your loan approved? Get answers to these questions and more.

How Do I Calculate an Auto Loan?

You want to know how much your monthly car payment will be. But what goes into that calculation? Arriving at a payment amount involves many different factors.

Why Should I Use a Credit Union for an Auto Loan?

There are plenty of advantages to getting your auto loan from a credit union rather than a traditional bank, including the possibility of lower interest rates, which can save you money.

Apply for Your Auto Loan Online Today

Are you ready to take the first step towards purchasing a new or used vehicle? We make it easy to get started quickly.

Disclosures

APR= Annual Percentage Rate. Rate advertised is as low as, and based on credit worthiness. Rate advertised includes a .50% discount for electronic payment from a United Teletech Checking Account.